Semiconductors have broken out to new highs, and one investor is targeting more gains in one of the industry’s top performers.

Marvell Technology (MRVL), whose chips are used for data storage and networking, has climbed 11 percent in the last week. That makes it the best-performing member of the Market Vectors Semiconductor ETF (SMH) over the same time period.

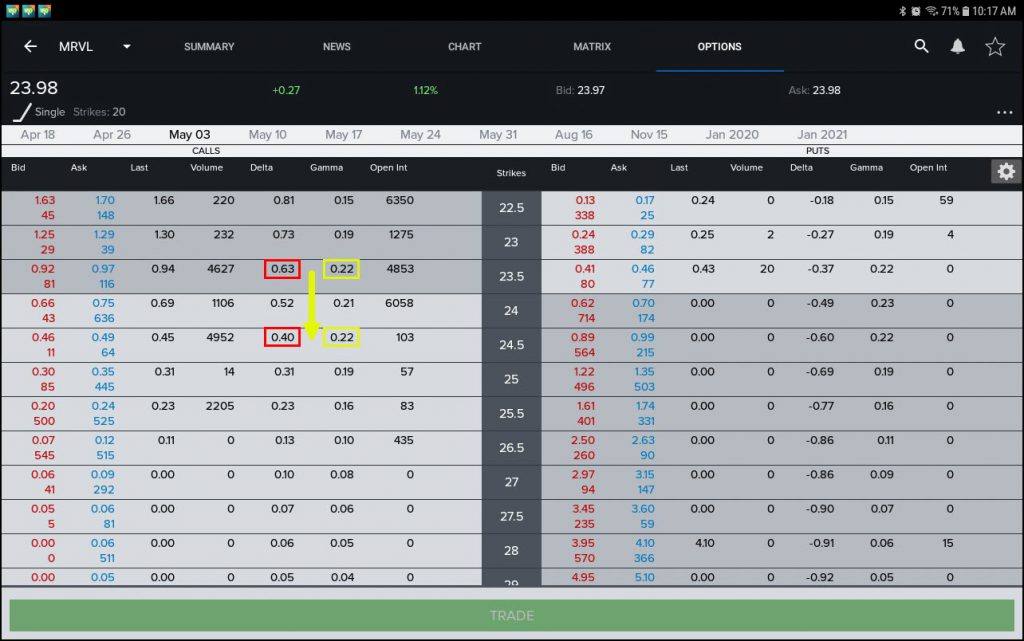

An institutional-sized options trader today is apparently looking for the run to continue. Check out this large transaction less than an hour after the opening bell:

- Some 4,500 3-May 23.50 calls were sold for $0.97. Volume was below open interest, which suggests an existing position was closed.

- A matching number of 3-May 24.50 calls were bought for $0.51.

- That translates into a credit of $0.46.

Calls fix the price where investors can purchase a stock. They can generate significant leverage when shares move higher but also expire worthless if no rally occurs. See our Knowledge Center for more.

Today’s trader probably entered the session with big profits on the 23.50 calls and wanted to take some money off the table. He or she then sold their existing position and rolled up to the 24.50s.

Making the adjustment protected almost half the capital at risk. It also preserved two-thirds of their delta and all their gamma. The result is a more efficient use of their money. (See options chain below.)

MRVL rose 0.8 percent to $23.93 and touched a new 13-month high above $24. Its next earnings report is estimated for mid-May.

Today’s option volume in the name is about average based on the last month, with calls accounting for a bullish 97 percent of the total.