The flood of initial public offerings (IPOs) continues, with attention now turning to a popular social-media service.

Pinterest (PINS) announced yesterday it would issue 75 million shares for $15-17 each. Based on its 529 million share count, that translates into an overall valuation of $7.9 billion to $8.9 billion. The number immediately raised eyebrows because PINS was valued around $12 billion in the private market 22 months ago.

Still, prices can change quickly in the world of IPOs. Ride-sharing firm Lyft (LYFT), for instance, initially floated a $68 number for each share and then issued its stock $4 higher. It subsequently spiked to $88.60 after trading opened, and then slid back toward the low $70s.

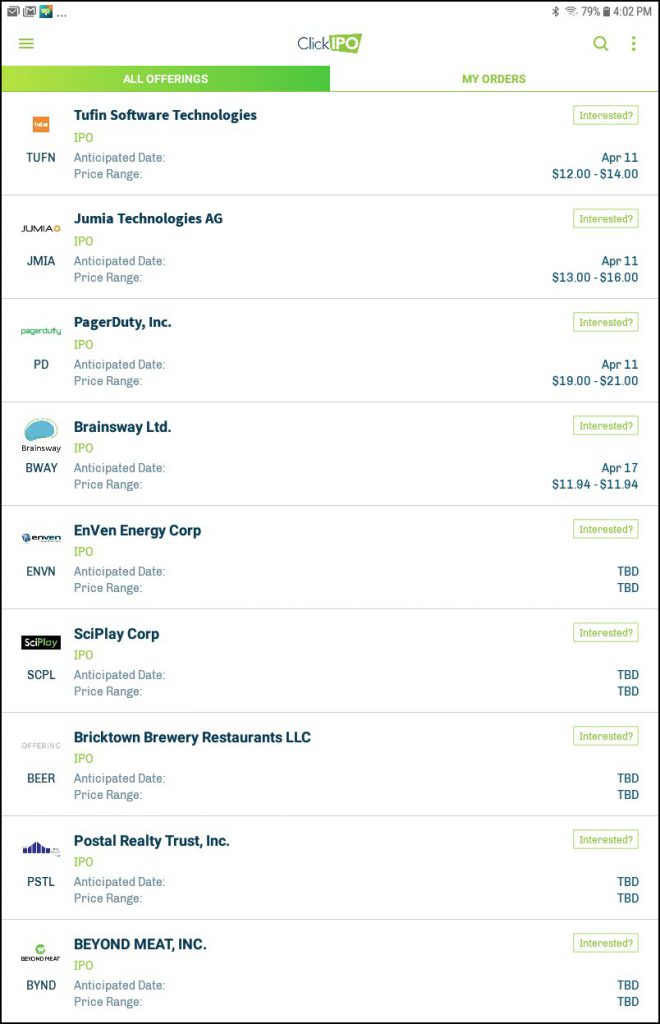

Even before PINS, other technology firms are coming to market. Here are some of the pending names, according to TradeStation’s partner ClickIPO:

- Tufin Software Technologies (TUFN): A Tel Aviv-based member of the up-and-coming cybersecurity industry. It plans to raise a little more than $100 million on Thursday.

- Jumia Technologies (JMIA): A Nigerian e-commerce company operating across Africa. It plans to raise about $195 million on Thursday.

- PagerDuty (PD): Another cloud-computing company, this time helping enterprises manage customer issues across various platforms. It plans to raise about $180 million on Thursday.

ClickIPO preview of upcoming offerings.