Esports are the latest thing in tech, and the first company dedicated to the field is going public next week.

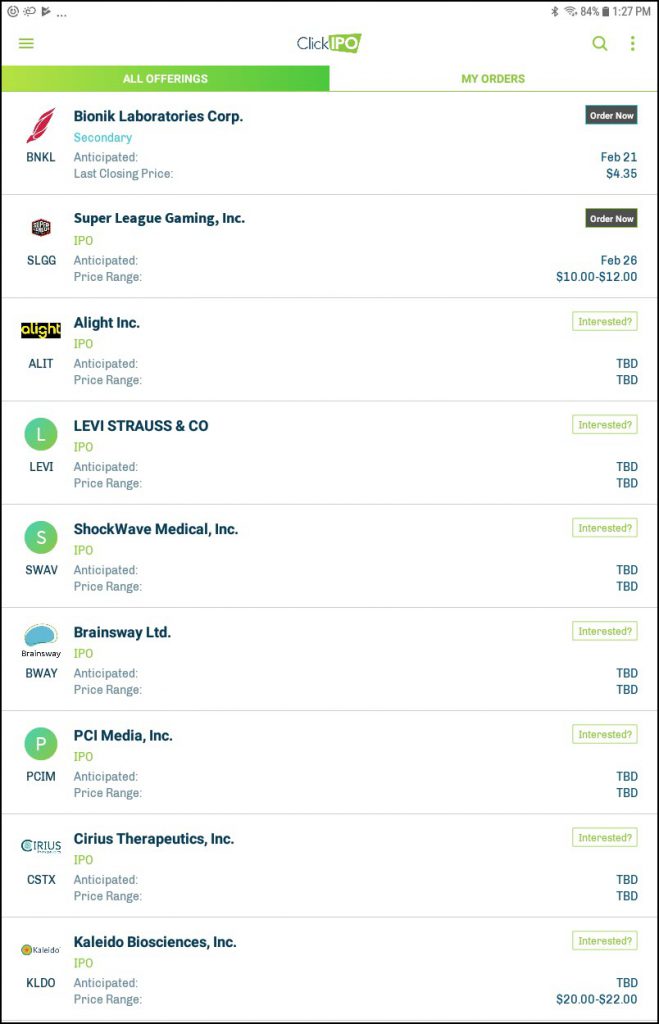

Super League Gaming (SLGG) plans to raise $25 million via an initial public offering (IPO) on Tuesday, February 26. There will be about 2.7 million shares offered for $10 to $12 each, according to ClickIPO.

Esports is a fast-growing industry with individuals and teams playing video games in front of huge audiences. Viewership has risen about 35 percent to 454 million in the last two years, according to research firm Newzoo. Revenue’s increasing even quicker as sponsors and media outlets jump on board.

SLGG comes to market as major video-game makers like Activision Blizzard (ATVI) and Take-Two Interactive (TTWO) struggle with a saturated market for their established titles. They’ve also found stiff competition from free games like Fortnite. However, SLGG has a different business model based on viewership, so it might be treated differently by investors.

Remember, 2019 is set to be a major year for IPOs as closely held tech giants like Uber, Lyft and Pinterest look to go public. TradeStation clients can potentially access the market via our partner ClickIPO.