This post is a translation of the weekly cryptocurrency analysis by Crypto Lab, a wholly owned subsidiary of Monex Group (Tokyo, Japan). Monex is the parent of TradeStation Group.

Market Price Review – Bitcoin Rallied Along With Litecoin

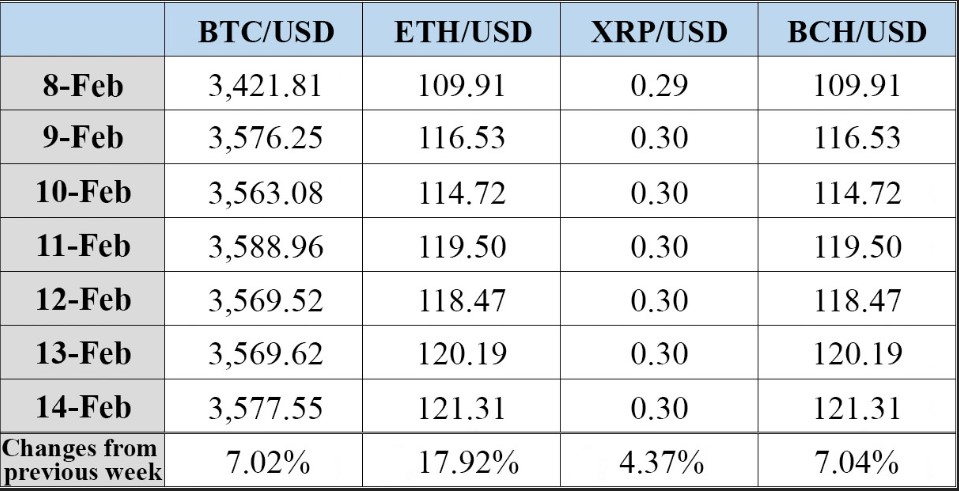

Bitcoin (BTC) rose sharply to $3,618 last weekend following the surge in Litecoin (LTC) It then dropped slightly on profit taking by short-term investors and has stabilized around $3,528.

Some think the move resulted from the influence of reports of an interview with the U.S. Securities and Exchange Commission official on the cryptocurrency ETF. This week, due to the progress of the US-China trade talks and growing expectations that the US government will not fall into a second shutdown, the mood in the stock market has become less risk-averse, and this has served to also boost the cryptocurrency market.

LTC rose more than 25 percent in a week owing to the introduction of Lightning Network’s technology, which LTC founder Charlie Lee has been promoting for some time. There have also been growing expectations of better anonymity.

Topics of the Week

- The FSA announced that the number of consultations sought concerning cryptocurrency has sharply decreased from the previous year. (2/8)

- Argentina’s public transportation IC card can be recharged with BTC. (2/8)

- Litecoin (LTC) has risen to fourth place in terms of market capitalization. Is this the influence of expectations towards the implementation of Mimblewimble? (2/9)

- UAE’s remittance-settlement company starts remittance service using XRP to Thailand. (2/10)

- The cryptocurrency index has been added to the Nasdaq index. (2/11)

- The ALS Association launches a charity campaign with TRON. (2/11)

- Binance DEX test net launch date set for 20th next week. (2/12)

- Bithumb enters business partnership with UAE’s block chain company to establish joint venture. (2/12)

- Intel announces enterprise solutions based on Hyperledger Fabric. (2/12)

- MUFG establishes joint venture with U.S. tech firm Akamai. (2/12)

- Coinbase adds secret key backup function to wallet. (2/12)

- GMO Internet announces policy to continue mining business in their announcement of financial results. (2/12)

- Reality Shares ETF Trusts withdraws application for cryptocurrency ETF. (2/12)

- Quadriga CX transfers Bitcoin to inaccessible cold wallet. (2/12)

- Bit Trade changes company name to Huobi Japan. (2/13)

- Minna no Bitcoin changes company name to Rakuten Wallet. (2/13)

- Ripple announces upgrade of XRP Ledger. (2/13)

- The U.S. SEC begins screening of cryptocurrency ETF reapplying for CBOE. (2/13)

- China IT giant Baidu officially releases Baidu Blockchain Engine. (2/14)

- The New Economic Federation announces request related to FSA’s cryptocurrency regulation. (2/14)

- Aerial Partners raises funds of $1,6 million from Yahoo subsidiaries and others. (2/14)

- Leading U.S. financial institution J.P. Morgan announces plans to issue its own currency JPM Coin. (2/14)

Next Week’s Market Forecast

We’re watching to see whether BTC will break $3,618.

In addition to positive factors such as the resumption of the U.S. SEC’s cryptocurrency ETF review and digital currency issuance plans by leading U.S. financial institution J.P. Morgan, the mood in the stock market is becoming less risk averse, making a situation where it may be comparatively easy to buy. Margin trading is also showing long-term dominance, indicating growing expectations that the market will rise as a whole. Additionally, with the expectation of the launch of the Binance Chain test net next week, should BNB go up before and after that, the growth that has been seen this week should continue.

On the other hand, market response to trends in businesses in the industry remains slow, and if the U.S. situation shifts, it is likely that price rises will once again be restrained.

Next Week’s Topics

- Nakamoto’s Den Conference to be held in Cyprus. (2/19-20)

- Blockchain Economy to be held in Istanbul. (2/20)

- Binance DEX test net launch is scheduled. (2/20)

- Coincheck DENKI service scheduled to resume. (2/20)

- CME futures BTCG 19 final trading day. (2/22)

Industry-Related Trends

Regulatory Trends: Turkish Police Arrest 24 Hackers

On 2/12, the local media reported that Turkish police arrested 24 people on suspicion of hacking domestic cryptocurrency-related companies and stealing virtual currency equivalent to 13 million Turkish lira (about $2 million).

According to the report, after the local companies that were hit submitted their report to the police, the suspects were caught as a result of investigations by the Cyber Crime Bureau. The police were able to pin down the identities of the suspects as they were dealing through an online game popular in Turkey. Some cash and cryptocurrency assets were seized from the arrested 24, and the whereabouts of the rest of the stolen money is still being investigated.

The tracking of hackers by cyber-crime police or white hackers became a hot topic last year due to the NEM incident. Eventually, the attacker could not be located and the topic died away when the NEM Foundation terminated the investigation. However, how police and government will jointly implement cyber-crime countermeasures in the cryptocurrency industry in the future will likely become a hot topic of debate. The need for not only KYC (Know your Customer) but also KYT (Know your Transaction) is being called out.

Technological Trends: BEAM Plans to Introduce Lightning Network in Response to Mimblewimble

On 2/12 BEAM announced plans to introduce Lightning Network (LN) in response to Mimblewimble.

BEAM is a block chain using the technology called Mimblewimble. Mimblewimble has often been discussed in the Bitcoin development community as a technology that can resolve both scalability and anonymity problems in bitcoins.

BEAM has a block time of 1 minute, which is much faster than that of Bitcoins. However, the fact that it is still not at the level of general electronic payment services, as represented by credit cards, is recognized as a problem, leading the company to plan the introduction of LN as a solution.

While Mimblewimble is difficult to implement with Bitcoin due to its design, its compatibility with LN has always been said to be relatively good.

BEAM launched their Mainnet last month and is presently still carrying out development to add new functions. Many people are looking forward to the LN introduction as one of those functions.

Individual Company Trends: Amidst Market Slowdown, Businesses within the Industry are All Announcing Fundraising

This week saw a series of fundraising news stories from cryptocurrency companies.

On 2/11, SendFriend, which provides remittance service to the Philippines, announced that it raised $1.7 million from Ripple and the MasterCard Foundation. The company is also known as a member company of RippleNet and aims to improve the efficiency of international remittance by adopting xRapid.

On 2/12 the survey company Chainalysis announced that it raised $30 million from leading VC company Accel and others. The company is developing KYT (Know Your Transaction) services for enterprises, and the capital procured this time will be used for establishing a new office in London and for expanding its services.

On the same day, various media outlets reported that Morgan Creek Digital, an asset-management company, raised $40 million from public pension funds and insurance companies to establish a new venture fund for cryptocurrency and block chain companies.

On 2/14 in Japan, Aerial Partners, which provides cryptocurrency tax services, announced that it raised $1,6 million from Yahoo subsidiaries and others. The company has increased the number of outside directors for the procurement of this fund and is strengthening their management system to expand their business.

Although the market price of cryptocurrencies has dropped across the board, the investment fever of institutional investors in cryptocurrency/block chain-related companies remains unchanged. In fact, it seems to be increasing, meaning that many companies are placing their hopes on the future of the industry.