This post is a translation of the weekly cryptocurrency analysis by Crypto Lab, a wholly owned subsidiary of Monex Group (Tokyo, Japan). Monex is the parent of TradeStation Group.

Market Price Review – While BTC Plummeted Sharply, It Remained Flat During the Week

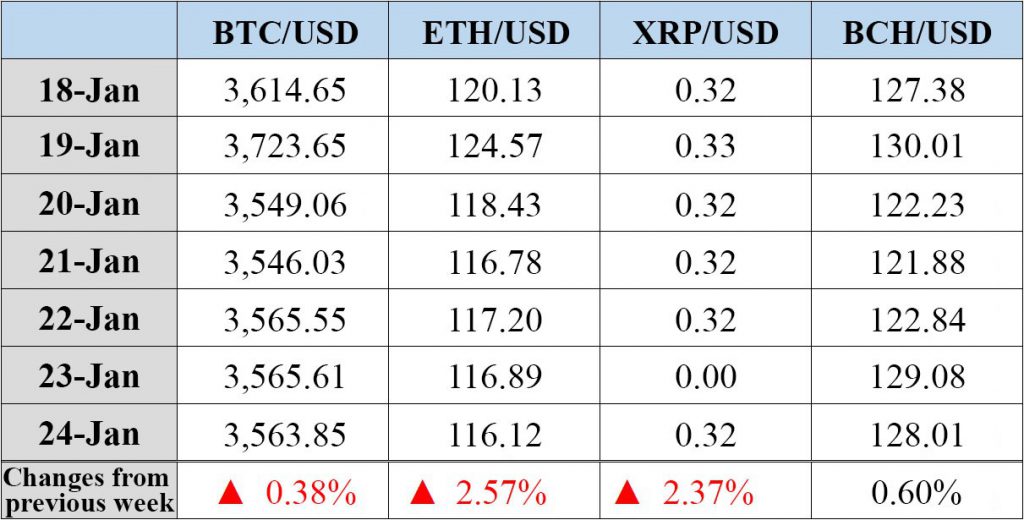

Despite the sharp rise and decline during the week’s beginning, Bitcoin (BTC) mostly remained flat due to its lack of direction.

Some say that this sudden decline was due to capital outflow from Coinnest, a Korean exchange, or due to price manipulation by Bitfinex and Tether, but that’s not certain. Although prices bounced later in the week due to the positive statement made by NASDAQ’s CEO and the synergistic influence of Bitcoin cash (BCH), sellers returned on January 23 when it became evident that the US CBOE’s cryptocurrency ETF application will be revoked. But since this possibility was mostly already reflected in the market, its impact was limited.

BCH showed strong movement and both its fiat and BTC denominations rose during the week, possibly because Bitmain reassured the public on its blog that there’s no conflict with BitcoinSV.

Topics of the Week

- ETH’s Constantinople Hard Fork to be Postponed Until the End of February. (January 18)

- Tsinghua University in China, in Collaboration with Ripple, Started a Block Chain Scholarship Program. (January 18)

- Rakuten Announced in April its Plans to Establish a Settlement Business Subsidiary and Restructuring its Group. (January 18)

- Two Executives of the South Korean Exchange Komid are Imprisoned for Misrepresenting Transaction Volume. (January 18)

- UK MercuryFX Succeeded in International Remittance Experiment using xRapid. (January 18)

- UAE and Saudi Arabia Set Up their Own Currency for International Remittance. (January 19)

- South Korean Exchange Coinnest Erroneously Distributed Huge Amounts of Cryptocurrency for Free. (January 21)

- Educational Donation Ad Titled “Bitcoin Baby” is Popular in UK. (January 21)

- Falcon Private Bank of Switzerland Introduced Directly Remittable Cryptocurrency Wallet. (January 21)

- SBI Group Invests in Card-Type Wallet Development Companies. (January 21)

- CEO of NASDAQ Shows Positive View on Cryptocurrencies. (January 21)

- Bitmain Reflected on 2018 and Commented on the BCH Hard Fork. (January 21)

- The Bank for International Settlements (BIS) has Released a Report on the PoW System. (January 21)

- Huobi Plans to Launch Proprietary Stable Coin in First Half of 2019. (January 22)

- Wallet Company Bitcoin.com Announces Partial Support for BitcoinSV. (January 22)

- London Stock Exchange Sells Trading Technology to Hong Kong Cryptocurrency Exchange. (January 22)

- Coinbase Supports Cross Border Remittance via SWIFT. (January 22)

- R3 Announces a License Agreement with ING, a Major European Financial Group. (January 22)

- The Annual General Meeting of World Economic Forum Held in Davos, Switzerland. (January 22-25)

- Pennsylvania Authorities in the U.S. Announces Guidelines on Cryptocurrency Businesses. (January 23)

- CBOE Revoked Virtual Currency ETF Application due to Closure of U.S. Government Agencies. (January 23)

- Bitfury Announces Tool that Promotes Lightening Network Settlements. (January 23)

- Binance Launches OTC Trade Desk. (January 23)

- Singapore Regulators Warn of Recruitments for Tokens that Violate Regulations. (January 24)

Next Week’s Market Forecast

Will there be a softer trend in BTC? Now that the approval timing of cryptocurrency ETC is unclear, investor’s fears are worsening once again.

The priority of long-term strategy is still dominant, and there were some short-term movements that pointed to such trend. The initiation of Bakkt futures trading will gain attention as another factor that may bolster a bull market, but the probability is low by looking at conditions in the U.S. The previously-volatile stock exchange market regained stability in 2019, and there are currently few factors that can significantly shake the cryptocurrency market. To increase the price under such circumstances, the degree to which new users can be acquired from the enhancement of exchange services will be the key.

Although prices may fluctuate up and down unexpectedly next week, it would be prudent to take note of the recent low of $3,470.

Next Week’s Topics

- AraCon Held in Berlin, Germany. (January 29-30)

- Decentralized Summit Held online. (January 29-30)

- Japan Blockchain Conference Held in Yokohama. (January 30-31)

- Block Confex Held in Ho Chi Minh. (January 30)

- Zilliqa Held Internet Debriefing Session on its Road Map. (February 1)

Industry-Related Trends

Regulatory Trend – UK FCA Releases Guide on Domestic Cryptocurrency Regulation

On January 23, the UK financial authorities (FCA) released a guide on domestic cryptocurrency regulations.

This guide categorizes cryptocurrencies into three categories (exchange token, security token, utility token), and indicates whether they can be supported under the existing regulations. Among them, the security token was pointed out, as expected, to be placed under the supervision of the FCA. It is said that it falls under a specific investment category stipulated by the financial services and market law, and is likely to be regarded as a financial instrument. It also indicated that utility tokens will also be under the FCA’s supervision if it is regarded as an electronic money.

The FCA is seeking the public’s comments regarding this guidance until April 5. After considering the opinions of the public, they plan on officially clarifying the domestic policies on cryptocurrency regulations.

Since countries around the globe are watching the moves of the United States, we hope that the U.S. will preemptively clarify their regulations to service as the guideline for European countries and contribute to the development of the industry.

Technology Trend – The Linux Foundation Released the Hyperledger Grid

On January 22, the Linux Foundation, which is developing an open-source block chain technology, announced the Hyperledger Grid, a solution for building a new supply chain.

Hyperledger Grid consists of libraries, data models and SDK to promote the development of smart contracts for distributed supply chains, and client interfaces. This will serve as a framework for development, and allows developers to develop applications in the most suitable format for their industry and market.

The supply chain has attracted attention as a representative case of block chain utilization, and various companies of all industries are experimenting with it as we speak. One notable example is IBM, which studies the technology daily for its application in various industries such as food, metal and energy.

The distributed supply chains have not been put into practical use yet, while various experiments are being conducted as aforementioned. I hope that the release of the Hyperledger Grid will accelerate the move toward its practical application.

Individual Company Trends – Bithumb’s Parent Company Signs a Memorandum with the U.S. OTC-Listed Company for a Merger

On January 22, it became apparent that Blockchain Exchange Alliance (BXA), the parent company of a major South Korean exchange called Bithumb, and Blockchain Industries (BCII), an investment company listed in the U.S. OTC market, have concluded a memorandum for a merger. The said companies plan to lay out the specific details with the goal of completing the merger by March 1.

This merger is called reverse merger (upside-down merger) and is commonly recognized as a listing strategy aligned with the initial public offering (IPO) in the U.S. By merging with a listed company, an unlisted company can access the capital market while avoiding the long and complicated listing process.

BXA’s CEO stated in the press, “there is a great growth opportunity in the North American region, and we are expecting high-quality results from this merger.” Some say that they are also striving to be eventually listed in the New York Stock Exchange and NASDAQ. If this happens, Bithumb will heighten its presence as a cryptocurrency exchange in North America.

Column – Thoughts I Had While Enjoying a Photo Album of Erika Ikuta

I wonder if anyone knows what January 22 is. Yes, it’s the birthday of Erika Ikuta, a member of Nogizaka 46 and a musical actress. Her second single photo album, “Intermission,” was released on the same day in 2019. It is a popular publication that has sold the most first-edition copies in the history of Kodansha International Ltd. as a female solo photo album that sold 200,000 copies for its first edition. Although it is embarrassing, I purchased it right away because I’m a fan.

After returning home from work, enjoying her photo album, a thought ran across my mind. Whether it is a token that circulates only within the fan community, or NFT (non-fungible token) that can potentially serve as a digitally collected token, I definitely want to have an “Erika Ikuta token.” I don’t mind purchasing a CD if it means getting my hands on it. Perhaps Erika Ikuta fans all feel the same. Although the handshaking certificates and goods of the AKB group already serve a role similar to that of a token, I had expected Yasushi Akimoto, a hit celebrity producer who always anticipate the future trends, to enter the token business in the near future.

I also had an idea of using blockchain to prevent the monopolistic purchasing and transferring of musical tickets of Erika Ikuda. Sadly, I had never won the lottery for a ticket to her musical. I would be fine if this is a valid lottery, but theater tickets are behind the times when it comes to taking measures against illegal ticket brokers, compared to a concert ticket. Even as we speak, malicious monopolistic purchasing/transferring activities are running rampant. It is not unusual for tickets to be exchanged at several times the normal price if a super-popular idol like Erika Ikuda is to perform. I hope that electronic tickets using blockchains, which will be mainly put into practical use in Europe, will soon spread to Japan so that tickets can reach the real fans like myself.

While I labored over the ideas about cryptocurrency and blockchains while viewing her photo album, I thought that maybe I am suffering from an occupational disease, but right around the end of my viewing, my head was basically filled with nothing but how “cute” she is. It was packed with colorful shots based in New York, and made me feel like I was watching a theater show called “Erika Ikuda.” It’s a piece that will make anyone like her a lot. I highly recommend it.