Stocks just finished their most tumultuous period in years. If there was ever a time for hedging with options, this was it!

After all, volatility can be a big pain for investors. You do your research to identify promising companies or exchange-traded funds (ETFs). Then a hurricane of bearishness sweeps in to wipe out all your hard work.

That’s why so many investors use puts as a hedge. Let’s consider this basic options strategy.

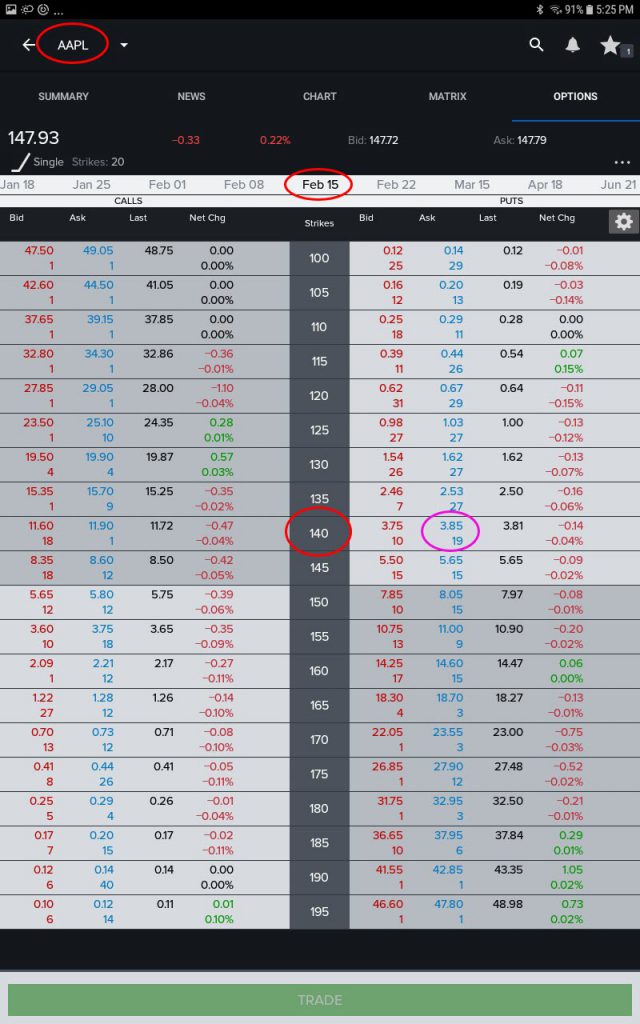

Puts give you the right to sell a certain security at a certain price over a certain time frame. The price is called “the strike” and the time frame ends with “expiration.” Puts are identified by these key elements (outlined in red on screenshot below):

- The underlying security: This could be Apple (AAPL), the SPDR S&P 500 Trust (SPY) or countless other products.

- The strike: At what price in dollars can you dump the security?

- Expiration: The last day the puts are effective. They’ll go worthless if they’re “out of the money.”

Protective puts can be viewed like insurance on a house. You want to live in it and enjoy it. You spent money on it — just like a good stock — and you don’t want it to burn down. But if it does, insurance will prevent you from going bankrupt to rebuild it. Puts work the same way, limiting the amount of money you can lose.

You can buy the options as insurance against a conflagration of volatility. They’ll go up in value if the stock drops below the strike. That limits the pain to the strike price, plus the premium on the option. Think about it like deductible on a homeowner’s policy. You don’t want to use it, but are covered just in case.

Two last things:

- An option contract controls a block of 100 shares.

- Their price is expressed on a single per-share basis. In the options chain below for AAPL, the 140 puts expiring on February 15 are offered for $3.85. (See the magenta circle below.) But that’s the price of protecting each individual AAPL share. Buying a single contract will cost $385 and protect a block of 100 shares.