Most clients know technology stocks are getting hammered. But just how bad is the selling?

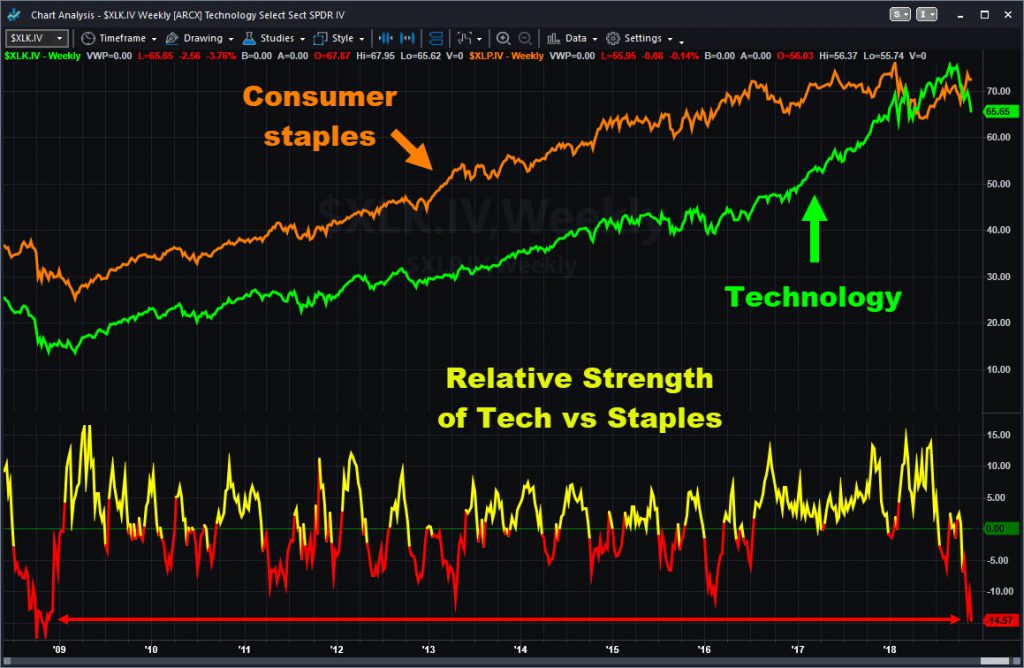

Pretty bad, it turns out, according to TradeStation’s award-winning platform. This chart compares the Select Technology Index ($XLK.IV) to the Select Consumer Staples Index ($XLP.IV). It shows tech is now lagging by the widest margin since the financial crisis in October 2008.

Today’s big names in the news are Apple (AAPL) and Facebook (FB). AAPL fell on yet another report about lower iPhone production, while FB slid to a new 52-week low amid infighting between high-ranking executives Mark Zuckerberg and Sheryl Sandberg.

But the selling runs much deeper. For instance, semiconductor stock Nvidia (NVDA) is down the most within the Nasdaq-100, continuing its slide from last week’s knarly earnings report. Software companies and electronic-payments firms are also down 4-5 percent despite a lack of news.

Want to learn more about TradeStation’s powerful analytics, or where money’re going now? Check out Market Action at 4:30 p.m. ET every Monday!

It looks like an intensified liquidation of “growth” stocks. It’s partially about earnings multiples and partly about economic jitters. But the bigger story seems to be a simple shift away from a large bucket of names that’s led the market for several years. Their stories were great for a long time, with each effectively growing their businesses: Streaming video, e-commerce, cloud-computing, data-analysis, smart-phone and chip proliferation.

One by one, these narratives have come under fire. Technical analysts call this “distribution” as long-term investors unload positions.

Still, other parts of the market have pushed upward. Most of them are “boring” or “safety plays.” Here are some S&P 500 companies hitting new 52-week highs today:

- Verizon Communications (VZ): Telecom

- Universal Health Services (UHS): Hospitals

- American Tower (AMT): Wireless towers

- Coca-Cola (KO): Soft drinks

- McDonald’s (MCD): Fast food