This post is part of an educational series on equity derivatives. Want to learn more? Sign up for our Options Stars 2018 symposium in Chicago next month.

Sometimes I love trading options so much I forget they were invented to be used in tandem with stocks. This post focuses on a way some big investors use these powerful instruments to manage their equity portfolios.

Say you started this week holding 100 shares of Apple (AAPL). Maybe you’re up nicely in the tech giant following its terrific quarter and fleet of new iPhones, but you’re wary about it stalling as other tech stocks languish.

Most clients know you can buy puts to hedge against a pullback, but that can be expensive. Did you know another form of protection can be more cost-effective and bring some other potential benefits?

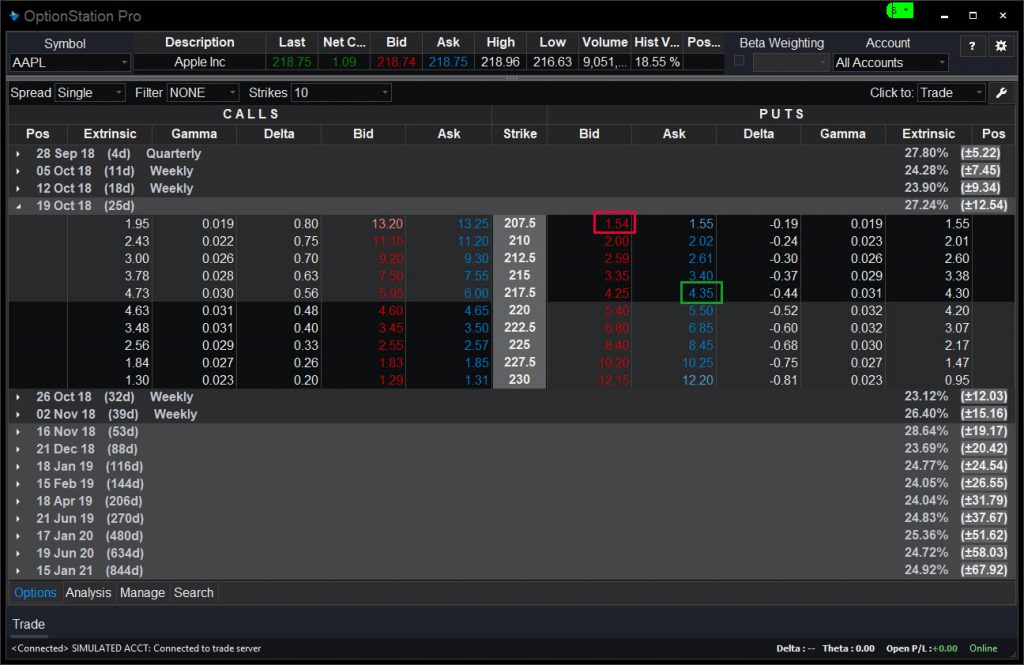

As this screen shot of OptionStation Pro indicates, the October 217.50 puts are offered for $4.35. That’s pretty costly and would require a drop all the way to $213 before they do you much good.

In cases like this, I’ve seen institutional investors use a put ratio spread. Assuming you have 100 shares, you would:

- Buy one October 217.50 puts for $4.35. (Marked with green rectangle.)

- Sell two October 207.50 puts for $1.54. (Marked with red rectangle.)

- The net cost would be $1.27. That’s $4.35 – ($1.54) X 2.

This would protect you against losses below $216.24, down to $207.50. It would also create an obligation to buy an additional 100 AAPL shares for $207.50 if they’re below that level on expiration. This results from the fact you’d be net short one contract. (Visit our Knowledge Center for more on put selling.)

Of course, this strategy can be adapted to different price levels and holdings of stock. If you wanted to protect 200 shares, you’d buy two contracts and sell four. That’s why it’s called a “ratio spread.” (Each contract controls 100 shares.)

Clients should realize there absolutely is risk in being short puts like this. But let’s put it in context. You already like AAPL and are sitting on profits. If it were to drop sharply, you might very well want to buy more shares.

And that’s the potential beauty of the put ratio spread. Not only does it offer a cheaper hedge against a modest drop, it also opens the door to automatically buy the pullback. In other words: You lose less money on a pullback, and have an order in place to add at lower prices.

So what’s the risk? Downside, my friend, downside. If AAPL really gets hammered, you’ll be hating life. The limited hedge will only offset some of the drop, and the short put will turn into an additional 100 shares you’re losing money on.

In conclusion, this kind of strategy can make sense on a “quality stock” or “core holding.” If you like a company over the long term and it runs to a high, you may want to consider a put ratio spread. Just remember the risks outlined in this article.

Disclosure: This post is intended for educational purposes only and shouldn’t be considered a trade recommendation. Click here for our previous lesson about in-the-money contracts.