The world’s most famous stock benchmark has been caged up all year. Is it ready for a breakout?

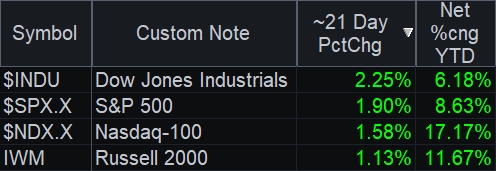

The Dow Jones Industrial Average ($INDU) is the best-performing major index in the last month, even though it’s lagged on a year-to-date basis. (See the RadarScreen® below.) It’s also the only major grouping of stocks that hasn’t pushed to new record highs since February’s gut-wrenching selloff.

Uncertainties about trade policy are one big reason for the Dow’s weakness. Some of that anxiety seems to be fading now that Washington and Beijing slapped relatively mild tariffs on each other. So much for a business-halting trade war…

Interestingly, Boeing (BA) and Caterpillar (CAT) are the top-performing Dow members in the last week. Both are known for their exposure to China.

At the same time those names have come to life, major tech stocks that led earlier in the year have languished. For example, Facebook (FB) and Netflix (NFLX).

The Dow rose 0.7 percent to 26,247 yesterday — its highest close since January 29.

In conclusion, this isn’t a trade recommendation and everyone needs to do their own homework. But there are signs of money shifting back to traditional blue-chip stocks as the geopolitical climate eases.