How schizophrenic is the transportation sector? Look no further than yesterday’s headlines.

On one hand, analysts at JPMorgan raised price targets on major railroads like CSX (CSX), Union Pacific (UNP) and Norfolk Southern (NSC). All three inched lower along with the broader market but remain near all-time highs. (Click here for more on the potentially bullish options activity in NSC.)

Airlines, on the other hand, weren’t so lucky. They’ve been in a steady descent all year, and took another drubbing yesterday after American Airlines (AAL) cut guidance because of weak pricing. The resulting 8 percent drop made AAL the worst performer in the S&P 500 yesterday. It was also the company’s biggest one-day selloff in over two years.

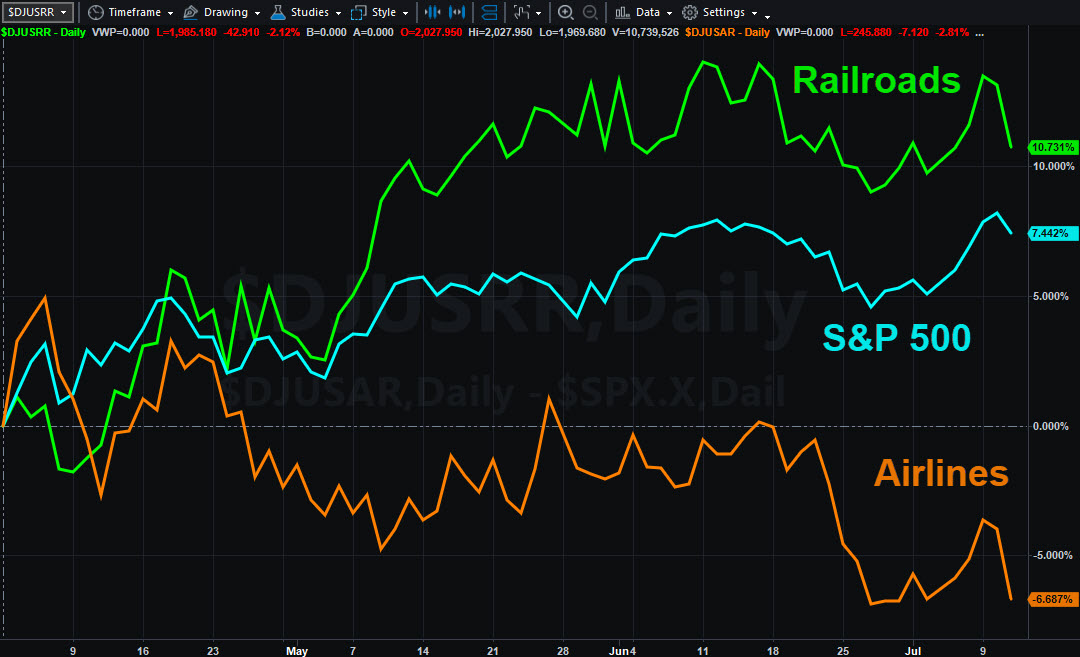

The chart below shows the divergence between the two groups since the end of March using two of the 100+ Dow Jones industry indexes included in the TradeStation platform. $DJUSRR follows railroads and $DJUSAR tracks airlines.

Despite being in the same transportation sector, the state of their businesses is very different. Railroads have benefited from the strongest traffic in years, while airlines are struggling with excess capacity.

This could worry investors with longer memories because airlines historically had too many planes in the air, forcing them into destructive price wars.

That ended when the September 11 terrorist attacks triggered a wave of bankruptcies. Managers responded by cutting costs, adding fees and limiting growth. But now that conditions have improved, you have to wonder if that discipline is starting to slip.