It’s easy to lose track of things when the market swings wildly like it did last week. So, let’s review a TradeStation feature that’s especially handy in times of volatility: Window linking.

As most users know, the platform consists of several different “apps”… things like charts, research tools, RadarScreen®, News and the Matrix. Each of these tools has its own purpose. RadarScreen lets you keep and monitor lists of symbols. Matrix lets you quickly place trades at a variety of levels.

When things are moving fast, you might find yourself constantly flipping from one window to another. How’s Apple (AAPL) doing? What about Nasdaq futures (@NQ)? Wait a sec, how about oil (@CL), or S&P 500 (@ES)? Is there news on Facebook (FB)?… Pretty soon checking all those levels, price changes and headlines can make your head spin.

That’s why TradeStation lets customers link these apps by symbol. It sounds small but the benefits are huge. (It’s also available on the web-trading platform.) Here’s a quick example of how it might be done:

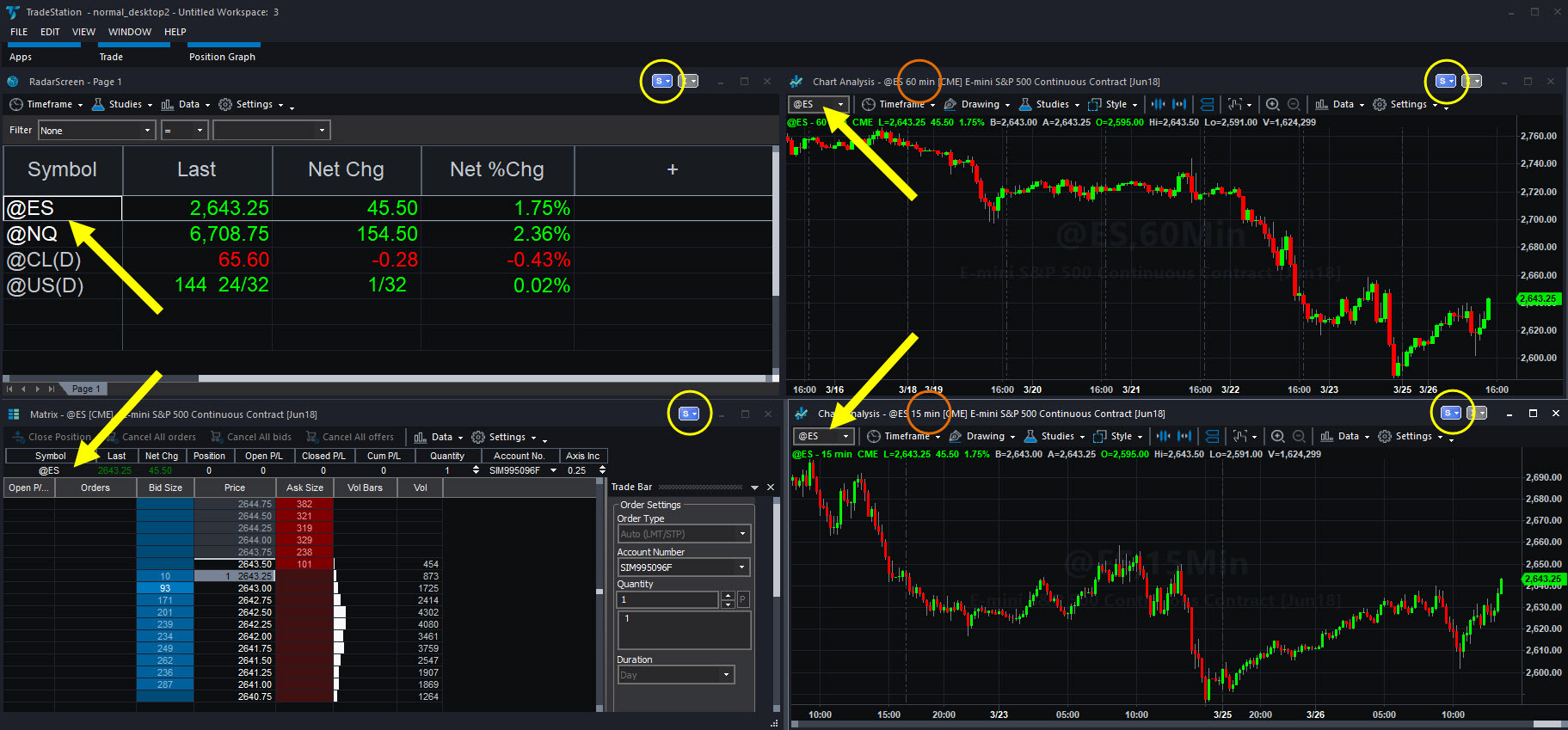

- Start with a list of important symbols in RadarScreen. These might be the big names you want to trade. I’ll be using CME’s E-mini S&P 500 futures (@ES), E-mini Nasdaq-100 futures (@NQ), Nymex’s Crude Oil futures (@CL) and CBOT’s 30-yr Treasury Bond futures (@US).

- Click on the Apps button and select Matrix. This lets you see both the levels where customers have orders, and where they’ve traded the symbol.

- Then open two separate Chart Analysis tools and click on Time Frame in both. Set one to 60 minutes and the other to 15 minutes.

- You should now have four apps in your workspace. Now comes the cool part. Click on the little S in the top right corner of each and select “Blue local symbol link.” (Or “Green local symbol link”…) Whichever color you choose, make sure you use the same one for the RadarScreen, Matrix and the two charts.

- If you want to automatically arrange them, click on Window → Arrange All.

Now you can click on the columns in RadarScreen to sort, maybe starting with the biggest gainers or losers. Then you can click on the symbol along the left side.

Notice that when you select a tickers, the other three windows will update on their own. You’ll be able to quickly see Bid and Ask trades on Matrix, along with two charts providing a quick glimpse of recent price action. Say there’s a level where you want to buy or sell. You can easily go to Matrix and click on the left side to buy, or the left side to sell. Say nothing interests you… then go back to RadarScreen and start all over again by clicking on another symbol.

This kind of functionality can really cut back on your key strokes and mouse clicks. That means less stress, and less stress can keep you from getting frustrated. That can keep you cool-headed when the heat is on. Just another way TradeStation’s powerful tools can help you overcome emotions and trade better.