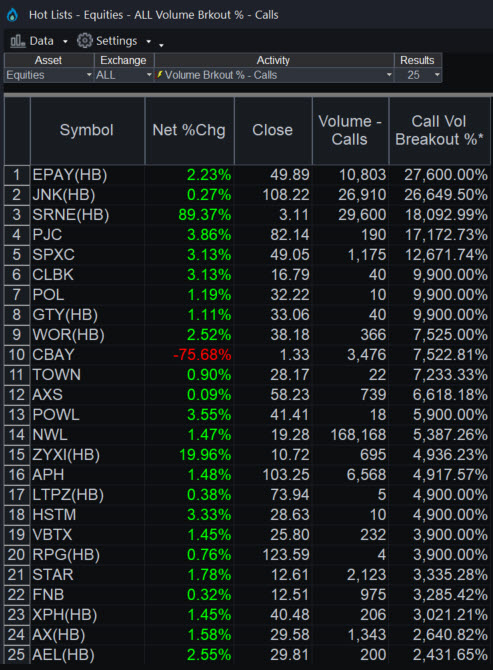

Options traders seem to think two obscure technology stocks are poised for rallies.

They first targeted Pinduoduo (PDD), amassing about 15,000 December 39 calls in the Chinese e-commerce firm. Most of the blocks crossed the tape for $0.60 to $0.80.

Bottomline Technologies (EPAY), a New Hampshire-based fintech, came later in the morning. Traders bought more than 7,000 of its January 55 calls, mostly for $0.70 and $0.75.

Calls fix the price where a stock can be purchased, so they tend to gain value when shares rally. Large purchases are sometimes viewed as signs investors see upside potential.

PDD rose 7.44 percent to $36.52. It was rebounding from its biggest crash ever last week, caused by weak quarterly results and disappointing forward guidance.

EPAY, on the other hand, has been climbing since it beat estimates on November 8. It was the company’s second straight better-than-expected quarter, following a huge rally in and pullback since early 2017. EPAY ended the session up 2.23 percent at $49.89.

The activity drove overall options volume in EPAY to record levels. It was also well above open interest in the respective contracts, a sign of positions being opened.