A whole new world of digital media is starting this month, thanks to some of the biggest companies in the world.

Two new online video services with the potential to reach hundreds of millions — if not billions — of viewers just launched. In coming seeks, two giant new cloud-based video-game platforms will also go live.

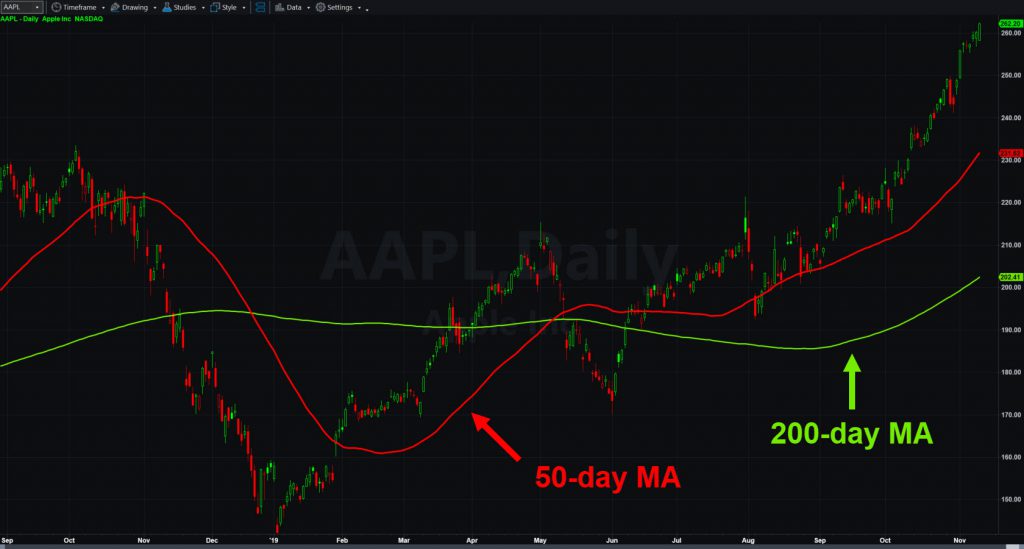

Apple (AAPL) got the ball rolling on November 1 with Apple TV+. Costing just $5 a month, the new streaming service has a modest content library. But it will help the world’s most valuable company evolve itself from high-end gadgetry into subscription-based services. That will make its revenue more reliable and prompt investors to pay higher valuations for the stock.

Walt Disney (DIS) followed today with Disney+ for $6.99. Perhaps the most famous media outfit in the world, DIS will offer titles from Pixar, Marvel and Star Wars. Viewers will also get instant access to Avengers: Endgame. It’s a potentially key evolution for the for the 96-year-old company, which exploded to new highs when Disney+ was announced in April. It’s consolidated since.

Video Games in the Cloud

The video-game offerings start with Alphabet’s (GOOGL)’s Google Stadia next Tuesday, November 19. Its $9.99 monthly subscription provides users with a library of more than 30 games. Stadia is designed to work with the Chromecast connectivity system via a $69 controller.

The big innovation is its cloud-based architecture, letting games move beyond traditional consoles to mobile devices. GOOGL also plans to roll out a free version next year with lower-quality video and sound.

Microsoft’s (MSFT) xCloud is the last, and most mysterious service. There’s no price or official launch date yet, but we know it’s based on the existing xBox service. xCloud will also compete against Google Stadia, so most fans expect more details to emerge in the next week or two.

No Going Back?

Take a step back and think about it:

- Three of the four companies are blue-chip members of the Dow Jones Industrial Average: AAPL, MSFT and DIS

- Three of the four have the largest market capitalizations in the S&P 500: AAPL, MSFT and GOOGL

It’s no longer a question of new disruptors like Netflix (NFLX) or Roku (ROKU) growing from the ground up. These are the biggest and most powerful tech firms in the world, trying to change the face of media forever.

Some readers of this post may remember the advent of television. Others may recall the old cartridge-based titles of the 1970s and 1980s, or the rollout of DVD-based games in the early 2000s. Then last decade, video-game access went online.

Finally, remember that 5G Networking just launched in China and is coming to the U.S. soon. It will arrive just in time for these new services, making them more powerful and fueling demand for higher-speed connectivity.

Each time technology takes a leap forward, there’s no going back. November 2019 could be one such turning point everyone will remember years into the future.