The good news keeps coming for chip makers, the hottest space in the market over the last month.

Digitimes reported this morning that Taiwan Semiconductor (TSM), one of the biggest manufacturers on the planet, just got a flurry of orders. It’s now running its foundries at full capacity in response, according to unidentified sources cited in the article.

The story is one of the latest positive developments for a business that was slowing just a couple of months ago. Other events in recent weeks include a mergers and executives predicting a rebound in orders.

Advanced Micro Devices (AMD), often one of the most popular symbols for TradeStation clients, has been the top performer in the space. AMD’s up 24 percent in the last month and 59 percent so far this year. It recently benefited from news its chips will help power Alphabet’s (GOOGL) Stadia, a massive cloud-based video-game service.

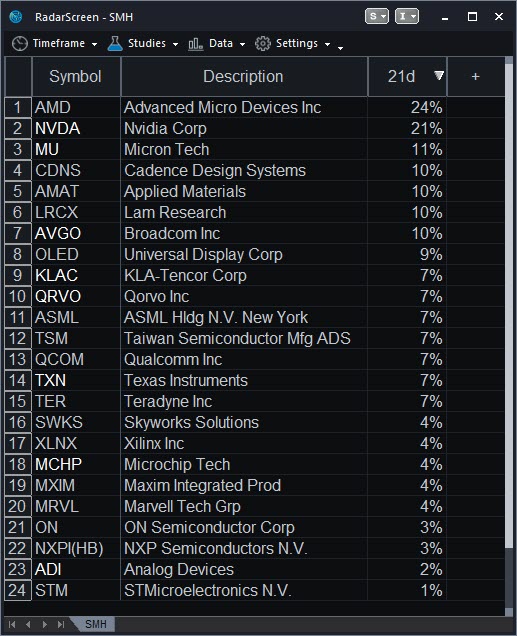

To compare other major names, we loaded members of the Market Vectors Semiconductor ETF (SMH) into RadarScreen®. We then added a simple custom indicator ranking them by 21-day return. That’s pretty much the same as a month when you account for weekends.

Here’s the single line of EasyLanguage® code for the “21d” indicator:

Plot1((close / close[21] ) -1);

And here are the results:

AMD, along with Intel (AMD), also rose today on bullish recommendations by Nomura.

Ironically, on Monday the Semiconductor Industry Association reported that shipments fell 7.3 percent in February. That was the sharpest drop in over two years. However, that news has a time lag. Now, the market’s looking a shift toward stronger conditions in the spring.