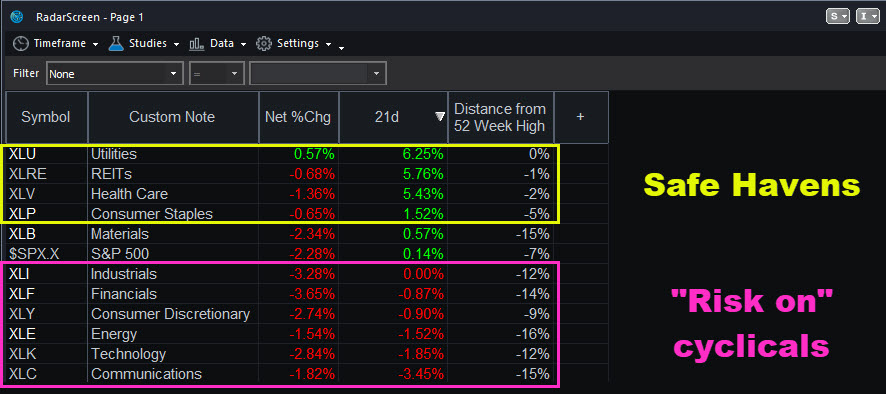

The market’s shift toward “safe havens” is continuing.

Utilities, consumer staples, real-estate investment trusts and health care are outperforming again today. They all benefit from lower interest rates and are less exposed to swings in economic growth.

Meanwhile financials, industrials and technology are down 1-2 percent. Those stocks behave the opposite, shifting more dramatically with underlying business conditions.

The shift in sentiment comes as investors worry about slower economic growth and trade uncertainties with China. The Federal Reserve’s apparent move toward lower interest rates also supports the trend because that usually helps stocks more valued for income, like utilities and REITs.

On the other hand, lower rates can hurt banks and financials because it “flattens the yield curve.” (This has been a common story in the news this week.) The ever-important 10-year Treasury yield has slipped back under 3 percent, while the 2-year yield has remained around 3 percent.

In conclusion, stocks have bounced sharply in the last week. Much of that was based on optimism about an imminent trade deal with China. But now as reality settles in, the more dominant trend this quarter seems to be reasserting itself.