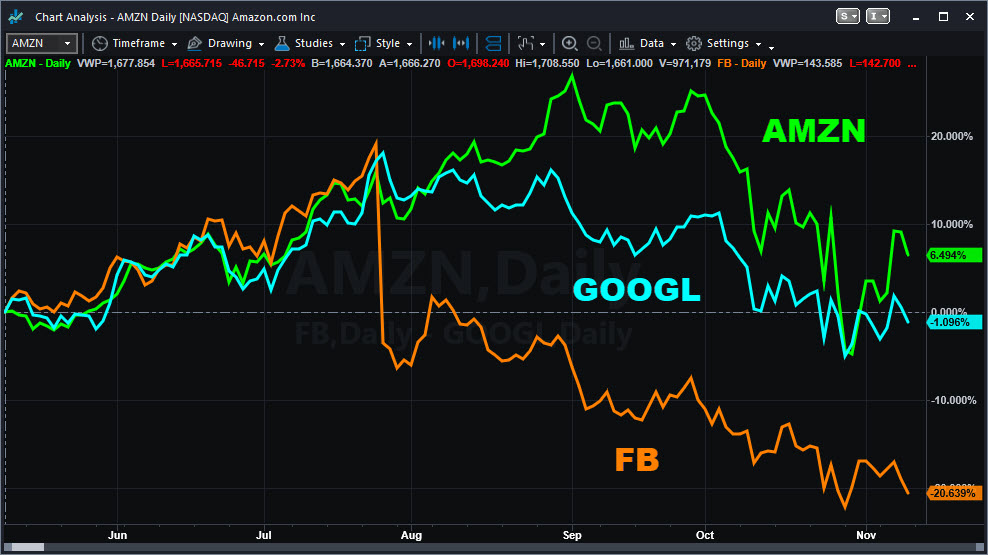

Amazon.com (AMZN) has disrupted plenty of industries, and now the e-commerce giant is challenging major players in Silicon Valley.

We’re talking about digital advertising, a field long dominated by Alphabet (GOOGL) and Facebook (FB). While those two companies control more than half the market, they’ve shown signs of peaking at the very same time AMZN is taking off.

Last quarter, for instance, the Seattle-based retailer reported a 122 percent increase in its “other” business unit that mostly consists of advertising. GOOGL, on the other hand, expanded just 20 percent and FB saw its growth slow to 33 percent from 42 percent the previous quarter. Forget about AdWords; we’re talking about Ad Wars!

There may be reasons to think the battle will continue. First, Jeff Bezos is only now entering the market in a big way. Second, his company has spent years building a customer base and traffic. Did you know AMZN is the No. 4 web site in the U.S. by traffic — ahead of destinations like Yahoo and Twitter (TWTR)?

Shoppers already use AMZN not just to purchase, but also to find merchandise. Almost a year ago, industry watcher Survata found almost half of product searches (not general web queries) begin on AMZN. Its large, captive audience of customers is ready to spend. That differentiates it from the eyeballs on GOOGL or FB, many of which are doing research or chatting with friends.

Another research firm, Jumpshot, made the interesting point in September that AMZN’s market share has peaked around 80 percent in several merchandise categories. That’s not great news for their product sales, but now Bezos can pivot to hitting those shoppers with ads.

Piper Jaffray has been excited about the trend because so much of the new revenue will pass directly to the bottom line — almost like “free money.” Those high margins, estimated to be well over 50 percent, could soon make advertising a bigger profit center than AMZN’s AWS cloud-computing division, according to Piper.

But it’s not all peaches and cream for AMZN. Remember its core retail business is showing signs of market saturation, which explains last quarter’s revenue miss and stock decline. At the same time, traditional merchants like Wal-Mart Stores (WMT) and Target (TGT) are starting to compete after building their own e-commerce businesses.

The real story is that for years AMZN, FB and GOOGL co-existed. AMZN sold products, while GOOGL and FB dueled for advertising. Now AMZN is turning into a competitor and starting from a position of strength.

Speaking of positions of strength, that seems to exactly what FB has been losing. Not only has the social-media giant’s traffic shown signs of peaking. It also alienated small business owners by changing its news feed earlier in the year. Meanwhile newer offerings like Stories and Video have yet to fully catch on.

Amid that flux at Mark Zuckerberg’s firm, AMZN may seem like a bastion of stability and reliability for advertisers.

Taking a broader look at these three companies’ finances, investors may notice AMZN has less potential currency risk than FB and GOOGL. More than 60 percent of AMZN’s revenue last quarter came from North America, versus 46 percent for FB and GOOGL. It’s something to bear in mind as weaker global growth weighs on foreign markets.

In conclusion, large technology stocks rose in tandem for years as each stuck to its main business. But now as each shows signs of reaching saturation, they’re starting to compete with each other. That could have big implications for profit growth, margins and stock valuations.

This post considered how AMZN may invade the advertising market. Next time, the hunter becomes the prey as Microsoft (MSFT) challenges AMZN’s dominant position in cloud-computing.