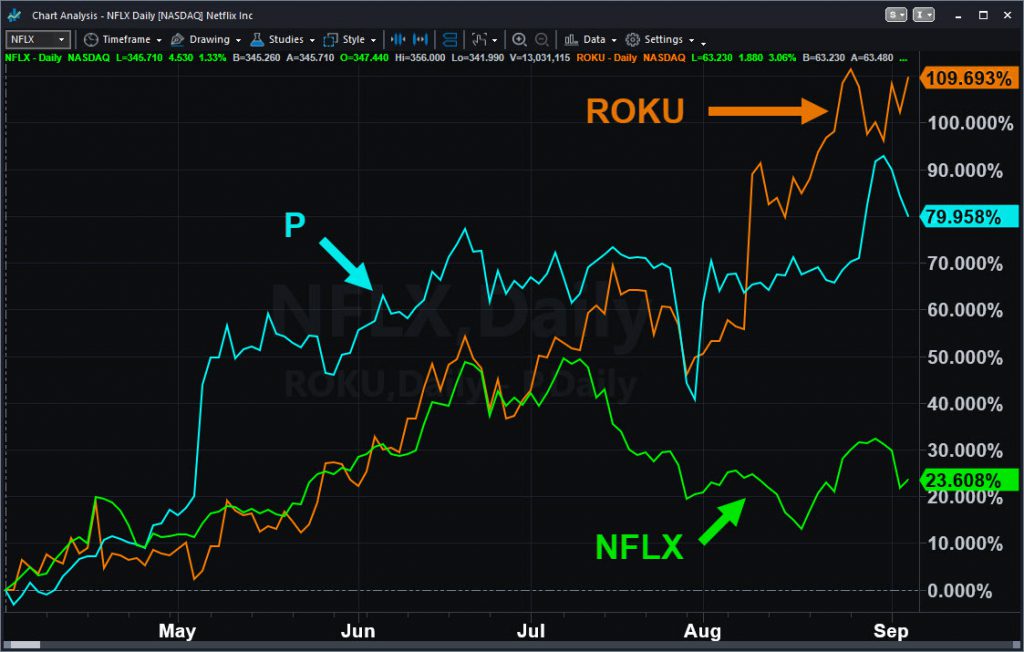

Netflix (NFLX) is undeniably one of the hot stocks in recent years. But did you see it’s lagged smaller competitors for the last two quarters?

Roku (ROKU) has more than doubled since the end of March and Pandora Media (P) has gained 80 percent. NFLX rose just 24 percent over the same period.

As the TradeStation chart below shows, the difference in performance began even before the last set of quarterly numbers. But it really widened in July after CEO Reed Hastings announced weak subscriber gains. His stock has yet to recover from the following selloff.

P, on the other hand, gapped higher on August 1 as subscription revenue spiked 67 percent. Management also boosted rates paid by advertisers. About a month later, Raymond James said its app was trending powerfully on iOS and Google Play. Most interestingly, the analyst was looking at July and August — two months after the strong quarterly results.

ROKU’s breakout came on August 9: “Robust active account growth expanded the reach and scale of our TV streaming platform,” said the shareholder letter. “At the same time Roku captured a bigger share of TV advertising budgets and continued progress on monetization.”

Earnings and revenue both beat estimates. Active accounts rose 46 percent. It had a brief drop last week on fears of competition from Amazon.com (AMZN), but has mostly clawed its way back.

The David-and-Goliath story between these companies fits in with the broader trend of smaller tech firms standing tall as old giants like Facebook (FB), NFLX and Alibaba (BABA) totter. The shift in sentiment seems to result from investor exhaustion with “FANG,” plus some real underlying differences in performance.

After all, technology is all about disruption. NFLX did plenty in its day, but now it may be the one to get disrupted.