Just how bad is the mess overseas? Pretty bad and likely getting worse.

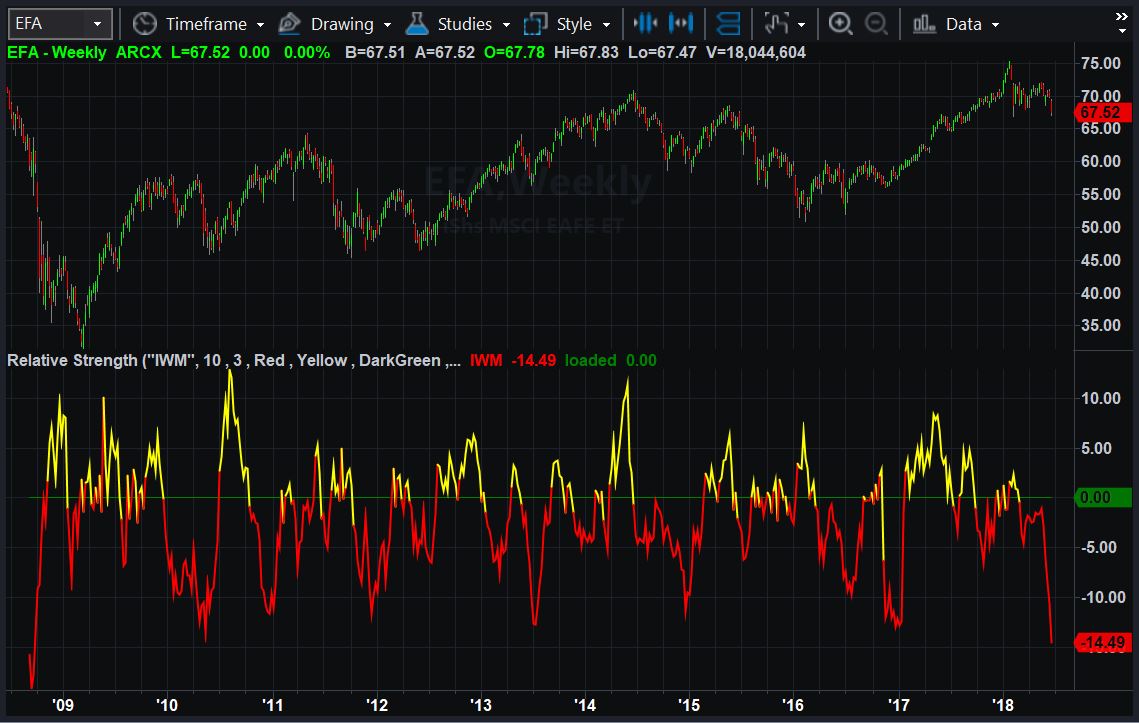

Global stocks are lagging domestic small caps by their worst ratio since late-2008. Just look at the TradeStation chart below comparing the iShares MSCI EFA fund (EFA) with the iShares Russell 2000 (IWM). EFA is a broad measure of international equities while IWM focuses on U.S. companies.

The strength of U.S. has drawn plenty of attention recently, especially because of good economic data at home. Almost the opposite has happened for global stocks. Today we wanted to quickly review some of those negatives for readers.

Slower economic growth is public enemy number 1. In the last week alone, for instance, Germany’s Bundesbank and Ifo business group cut their growth forecasts for the country. The valuation of China’s much-touted Xiaomi smart-phone initial public offering (IPO) has been slashed, and Japan is sliding back into its old deflationary spiral.

Mixed in, of course, are all the concerns about trade wars between the U.S. and China, Europe and Canada. Economists say these disputes hurt confidence, not a big surprise considering that other countries stand to lose business because they’re all net exporters to the U.S. (Meanwhile, a report today shows U.S. manufacturing confidence at a record high.) Two other factors make things worse for the Europeans: Plans to remove quantitative easing (QE) and political uncertainty. That second point is especially true as Italy’s new anti-establishment government settles into power and German Chancellor Angela Merkel battles for survival.

Things have been even worse in Latin America, where Brazil has been battered by a trucker strike. Argentina’s peso continues to spiral lower and economic migrants from Venezuela have invaded Colombia. And, to top it all of, Mexico is on the verge of electing hard-leftist Andres Manuel Lopez Obrador president on July 1.

In conclusion, problems involving trade and politics have grown for international stocks in the last month. And, at this point, there’s more reason to expect they’ll get worse before they get better.