Editor’s note: This post, part of a four-part series about options Greeks, was originally published on Tuesday, August 28, 2018.

So far, we’ve looked at delta and gamma. This week, we’ll turn to theta.

Theta: T is for “time decay.”

Theta measures how much time value an option loses each day. Therefore it’s always a negative number. Theta is expressed outright in cents.

Off the bat, remember we’re talking about time value, or extrinsic value. Options with expiration dates further into the future have more time value.

As some readers may already know, options lose this time value at a faster pace as expiration approaches. (The logic of this is simple: Because all kinds of craziness, or volatility, can happen over longer periods, options price in the potential for that uncertainty. But shorter time frames have fewer potential unknowns. Click here for our case study of a strategy that profited from time decay.)

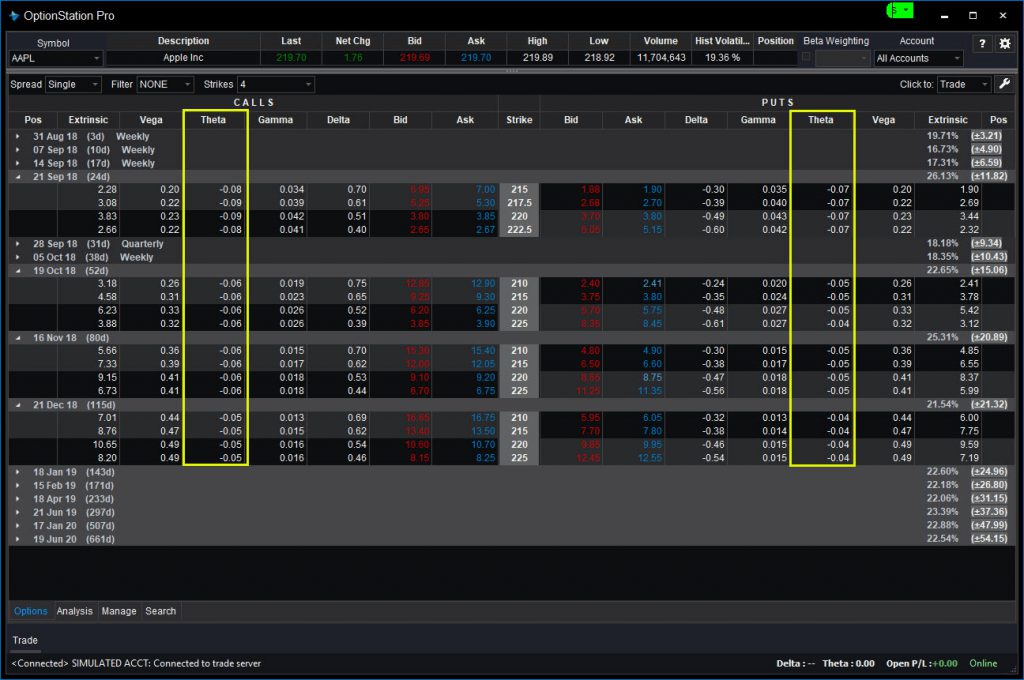

Let’s take a look at the options chain for Apple (AAPL) shown below. Notice how contracts closer in time have bigger absolute values for their thetas? September calls lose $0.08 or $0.09 per day, Octobers and Novembers lose $0.06, and Decembers a little less, etc.

You’ll also notice that theta tends to be the mirror image of gamma. Shorter-dated options have more gamma (price leverage) but lose time much faster. This is another way of understanding risk and reward. Everything has a price. In this case, the price of leverage is faster time decay.

It’s great if you’re right, but costly if you’re wrong. There is no free lunch — at least not in financial markets!

Here are some ideas on how to apply theta in your own trading:

- Be aware if buying options with higher thetas because they give you less time to be right about the direction a stock will move.

- When selling options, it may help to select contracts with higher theta. They’ll lose value more quickly, so it can potentially make sense to short those. (Always remember the risks of selling options.) And remember that a quick move will “hurt more” because you’ll be short gamma as well.

- Theta is a key principle in horizontal spreads (also known as calendar spreads) and diagonal spreads. These strategies essentially own longer-dated contracts and sell shorted-dated contracts as a way to shift different thetas in your favor.

In conclusion, theta is an important concept for clients new to options. Using it correctly may help you trade more effectively. Next week, we’ll explore “vega.”

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See Characteristics and Risks of Standardized Options. Visit www.TradeStation.com/Pricing for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement.